Intro

Over the past month, life has changed for everyone. These changes have affected us in ways that we could not have imagined at New Years. In my case, I was literally on my way back to Hanoi when I got a text at 5:00AM to tell me that Vietnam had closed its borders. So, I’m here in Salmon Creek, Washington, waiting for the borders to reopen.

As I sat contemplating what to do, a talking head appeared on TV exclaiming how big parts of the global supply chain had failed. I was taken aback by this, wondering if four weeks ago this commentator knew what a supply chain was; let alone now presenting themselves as an expert.

This pandemic has altered the way we do business, and in some cases probably forever. This is the first time in 40 years that I haven’t had to work a business continuity plan during a crisis of one kind or another (see appendix).

So, I decided to try to help practitioners understand what’s going to happen through this mess. The goal of these blogs is to help those that are now in the trenches figure what to do it. This will be part one and I’ll try to stay with you throughout this recovery.

What is Business Continuity?

Resiliency is the capacity to recover quickly from difficulties. It is also the ability of an object to spring back into shape; or demonstrate elasticity. Regardless of the type of business interruption, the fundamental role of a manager in business continuity is to protect the brand, and the company, by resuming “normal” operations as quickly as possible with a minimum of disruptions to the company.

When a Business Continuity Plan is implemented, vital resources such as cash, people and facilities will be diverted in unusual ways to ensure the long-term viability of operations. A Business Continuity Plan is vast and entails literally every aspect of a company. For most of us, the only experience with managing in this environment comes as an exercise of survival when a disaster strikes. Others have had to learn the practice from repeated incidents over time.

The first step for building a Business Continuity process is to do a self-assessment, starting with examining the company’s tolerance for risk through its People, Processes, and Tools:

- What defines a crisis that would trigger the formation of a response team?

- Who would be on this team?

- How does the team communicate and to whom do they report the details of their activities?

- If a disaster occurred would the company be resilient and keep going, or limit its losses via insurance and/or just pick up and move?

- Finally, are the systems agile and scalable to support changes in operations, or is the business in manual mode?

For most, this will be your first time in the world of Business Continuity.

Are We Trading?

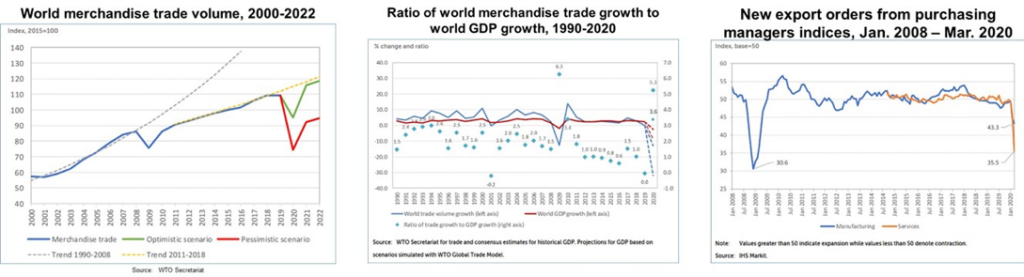

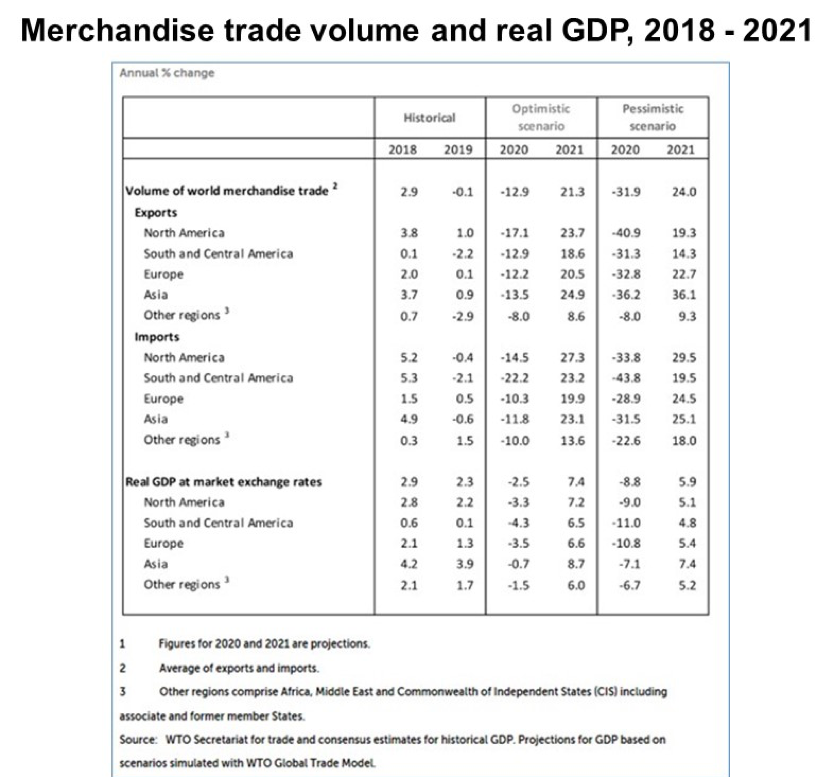

The most recent World Trade Organization (WTO) global forecasts are:

These show everyone falling off the cliff, but not predicting how or when we’ll recover. Right now, every government is grappling with how to reopen for business. Certainly, seasonality will play somewhat into this, but using historical data to create forecasts would not be accurate at this point.

Also, establishing a supply plan can be a real challenge right now. A Sourcing Leader needs to be careful calculating Total Acquisition Cost.

Cost cannot be the only factor in managing a supplier. Competitive pressures make Sourcing dependent on supplier performance, which means that quality and service can often be more important then cost. In this case getting material to feed demand may be more important, then cost savings.

Are We Moving?

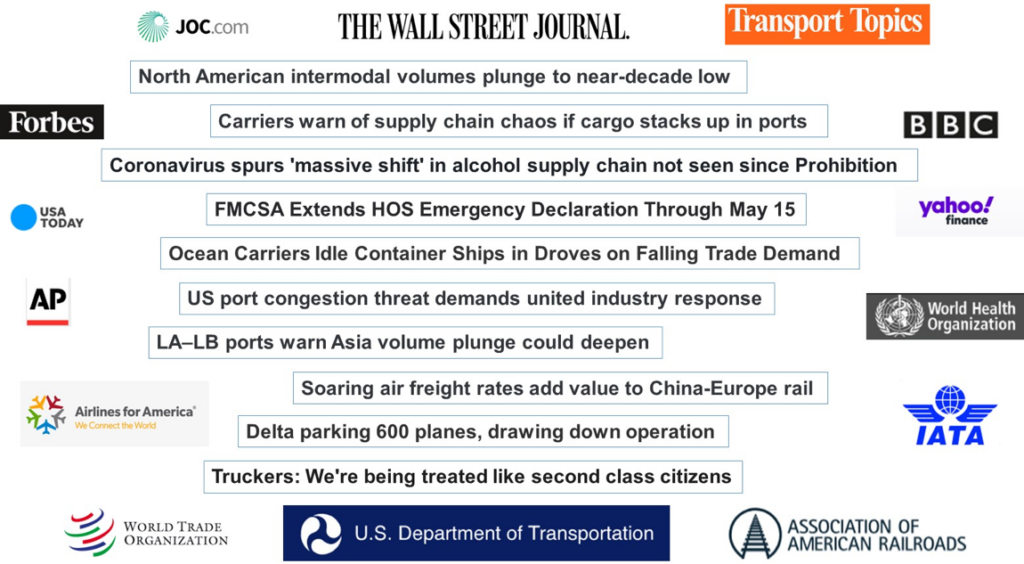

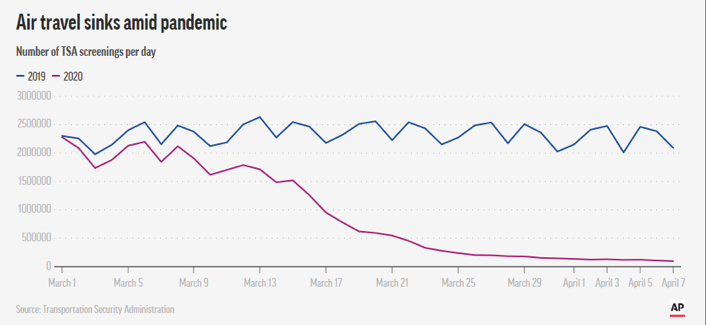

As air travel has become more accessible, volume has grown every year. But now the global quarantine is truly presenting unique challenges to those that have to run the international air travel system.

Most people don’t realize that the commercial air industry, transports between 45% and 50% of all global air cargo. Since most passenger flights have been suspended as a result of the pandemic, this lift capacity is no longer reliable, or even available.

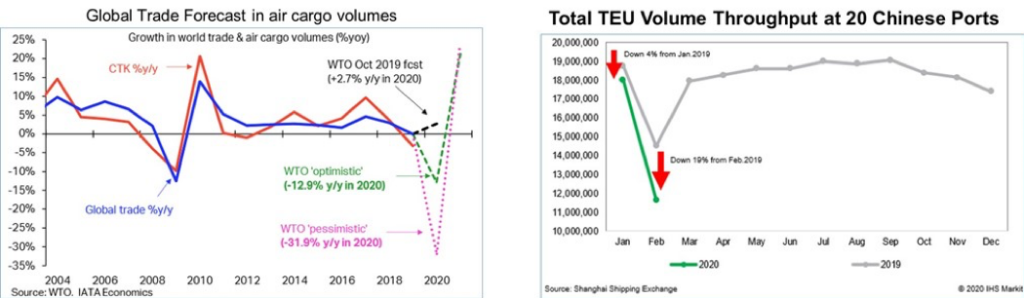

Since much of the commercial air and marine fleet has been parked, demand for intercontinental air freight has grown. Shippers, who would formerly move components such as castings, gear boxes, forgings, only by marine are now forced to transport these goods by air to feed factories.

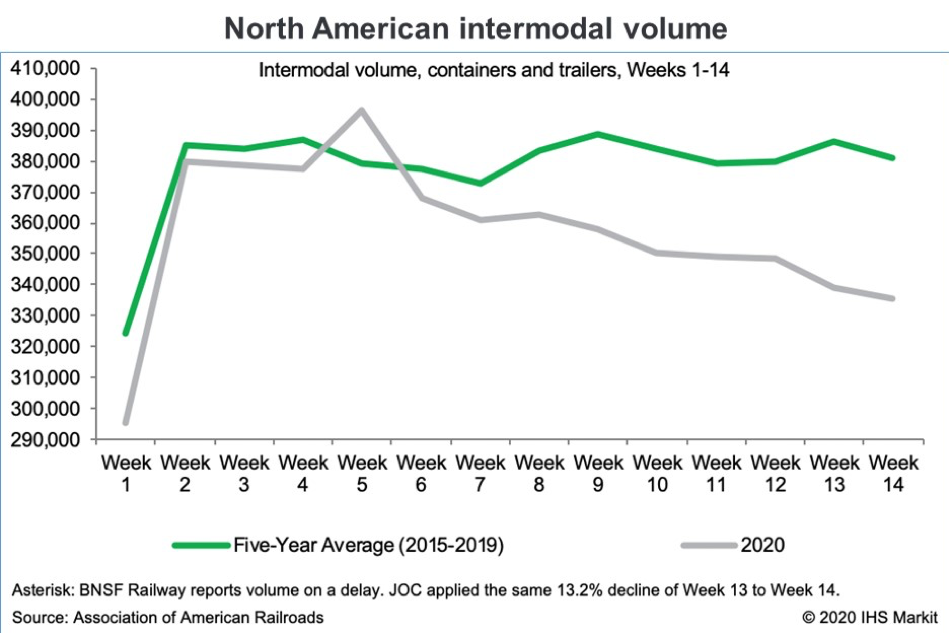

Moving to marine, the graph on the right says it all. Granted, part of the dramatic fall was a result of Lunar New Year on January 25, but the freefall afterward is staggering, with no ‘V’ shape recovery in sight.

Adding to this dilemma, many trade publications are warning of port congestion if shippers don’t clear their cargo from their port. This will be like having a global work stoppage, on top of slow transport.

What’s the outlook?

For the most part, business plans were put together in the 4th Quarter of 2019, with Q1 results now complete. How does this pandemic impact those assumptions and numbers?

Management’s principal focus should be on growing profits and cash flow which is imperative for the survival of a company. Aggressively managing the speed and agility of the Cash-to-Cash Cycle is a key component of business performance, as a business without sufficient cash is ultimately bankrupt. The three elements of Working Capital are Inventory, Payables, and Receivables. And, weaker companies with poor planning practices will greatly suffer from a lack of cash.

Conclusions

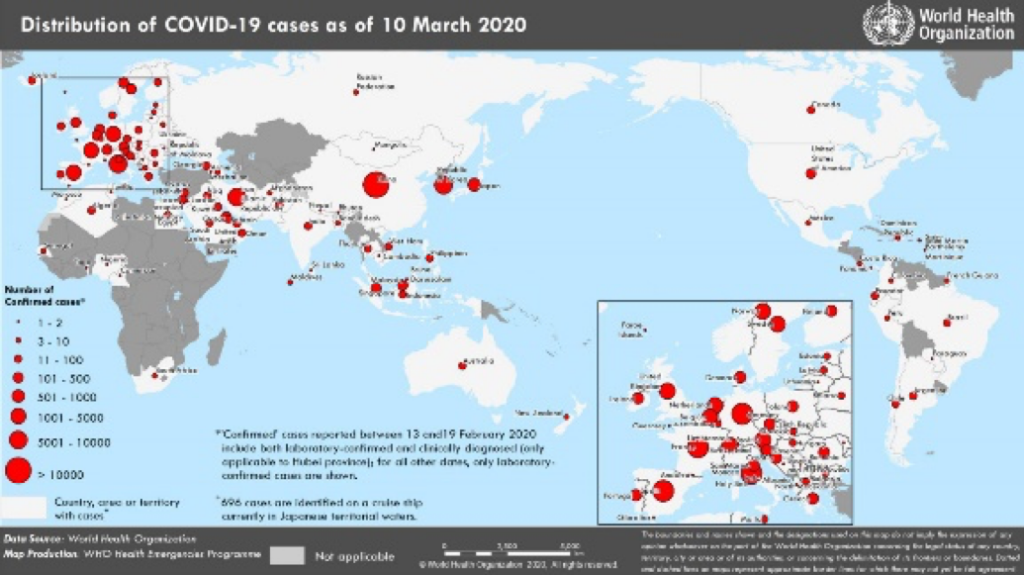

- This is truly a global pandemic; trade has slowed or stopped around the world.

- The assumptions of the 2020 Business Plan need to be immediately reviewed – specifically for:

- Revenue or Financial

- Sales & Growth

- Demand and Supply

- Productivity

- Businesses need to be careful with cash management in 2020 and 2021 by aggressively managing Working Capital – Inventory, Payables and Receivables.

- Inventories that were bought to cushion Lunar New Year downtime have now been used.

- Industries such as grocery, hardware, alcohol, are experiencing hyper, or uncontrolled, growth, while others are completely the opposite – completely down.

- Not much is moving globally, but what is, is very expensive. Port stoppages loom as shippers have not retrieved goods. Below is the North American intermodal forecast:

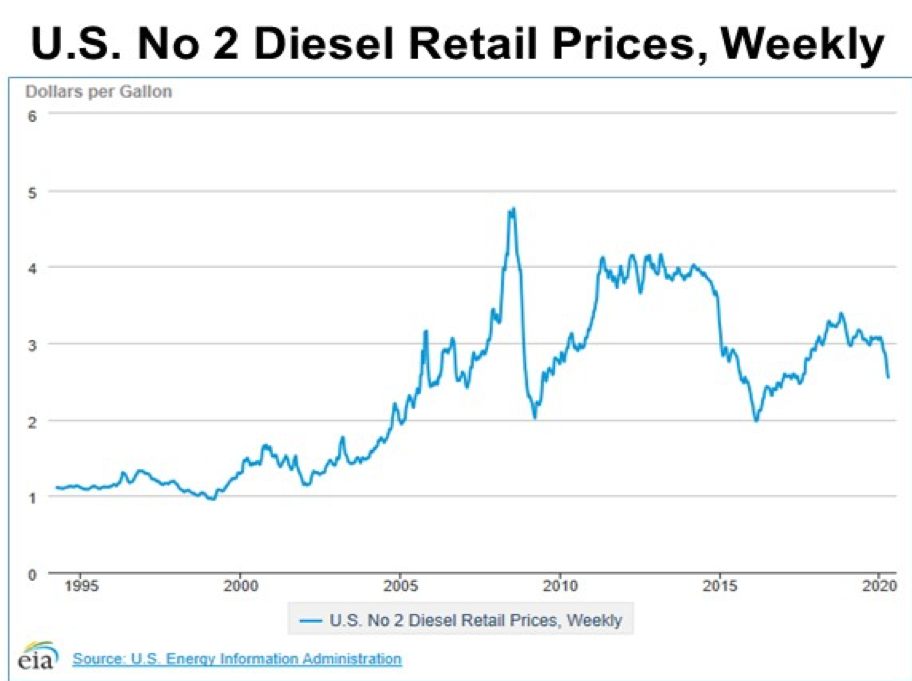

- The one upside is that fuel costs are down in the U.S.