Over the years, I’ve had the honor of having the Trade function report to me, and I’ve gained immense respect for the people in this profession. From my perspective, they’re always the most diligent, conscientious, no nonsense people. They are underappreciated, global in their mindset and are just trying to keep the business out of trouble. They literally move millions of dollars in cash (to pay duties) but are often vilified for saying ‘no’ when a business wants the answer to be ‘yes’.

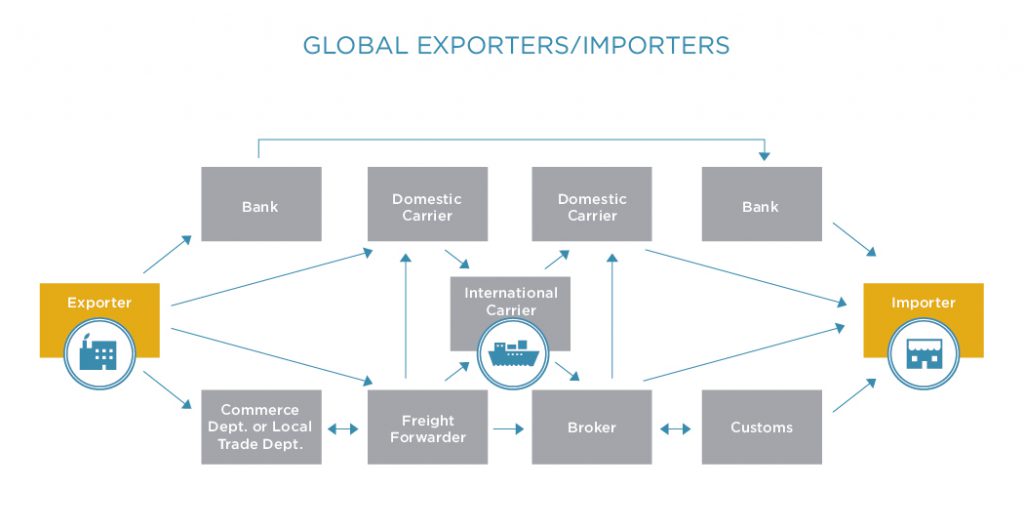

International trade is complex, and involves multiple parties with handoffs of product and data as borders are crossed. This highly complex process takes an elite team of experts who partner with their business colleagues to obey international laws while efficiently transacting business.

A business will fully comply with all applicable export and import control laws and regulations of all countries in which it conducts business.

Customs Laws – The requirement is to declare goods accurately on importation

Export Control Laws – Certain goods of a strategic nature require government approval before export. There are also restrictions and embargoes on exporting/ importing products from certain countries.

The objective is to sustain a global structure which enables rapid problem solving and continuously improves productivity while eliminating regulatory barriers to growth.

Managed properly, Trade becomes an asset by reducing cycle time, opening doors for growth, and creating productivity from a foundation of compliance. In the past I’ve been astonished when a business leader asked how to circumvent the U.S. embargo to Iran. I’ve also never understood the propensity of a supply chain leader to try to throw an extra undocumented box onto a trailer, or of a sourcing leader who puts a part into their suitcase because it’s too difficult to follow the process.

What they eventually learn every time is that the consequences of poor Trade practices include:

- A delay or seizure of goods in transit

- Operational disruption

- Loss of reputation and customers

- Fines and penalties

- Penalties with the impact on a business’s trusted importer status, which adds to cycle time

- Loss of business

The Trade Pyramid

I’ve found that the following illustration of the Trade Pyramid is the easiest way to convey what the function does.

The basic function of any Trade organization is to comply with the laws of the countries with which it does business, as well as ensure compliance with international trade rules. This is achieved by:

- Standardizing internal controls

- Classifying all products correctly

- Assessing internal risk and developing corrective action plans for areas out of compliance

- Submissions to government agencies as well as post entry audits

- Training throughout the business

- Pre-acquisition due diligence and post-acquisition integration

Once this is achieved the organization can build the ability to support supply chain operations and create productivity. This is accomplished by managing areas such as:

- Duty savings, drawbacks or (best of all) avoidance

- Broker management

- Collaboration with manufacturing and sourcing for technology and/ or product moves

- Working with Logistics to improve the physical and information flow of material

- Utilizing Foreign Trade Zones

Once an organization is compliant and producing productivity, the Trade function can help the business enable growth by assisting Marketing and Sales with opening doors. This is done by:

- Decontrolling or licensing product for export

- Furnishing customer duty preference request

- Providing regulatory advice

- Collaborating with Government Relations in areas such as HS codes in preferential free trade agreement negotiations among countries

- Collaborating with Sourcing in order to change the source of specific supplies in order to qualify as a specific origin that will result in a duty avoidance

Elements of a Great Trade Program

People

In my experience, the Trade function is often scattered throughout companies’ business operations. Sometimes it is housed entirely within Legal or Finance, while at other times it has been broken into subcomponents within Export, Import and/ or Customs. Trade personnel can suffer from a sort of professional identity crisis, not knowing who or which organization they serve: what they do know is that they will be chastised for slowing any transaction.

I’ve found the function to be most effective when it’s part of the supply chain. This keeps everyone focused on crossing borders legally and efficiently while providing a good dose of productivity and cash management.

Centralizing all Trade activities facilitates a greater impact to a business through extended global reach and improved focus on process improvement. It does this by providing:

- The ability to focus attention on regulatory requirements, growth and productivity

- Adequate resources that proactively manage trade policies and strategies

- Quicker responses to regulatory changes, risks and opportunities as they appear

By unifying the Trade functions, a business can create a foundation that focuses on the highest priorities, aligns the group into a common direction, and assesses talent across a business for career development with a standard set of tools to generate efficiencies.

Process

All products crossing borders are required to have accurate trade data. This consists of information for all raw materials, finished goods, manufactured items, and hand-carried items as well as samples. Accurate data is essential as the first step to a compliant Trade process. These basic elements are:

- Tariff Code

- Country of Origin

- Export Control Classification Number (ECCN)

- Net Weight

- Declared Value

This data is integral for EDI transmissions to customs agencies, the generation of Customs Imports and Export documents, creation of commercial invoices, as well as for Export control screening. After insuring that all trade data is accurate – including 3rd Party Purchased items – a business can intelligently and legally cross borders, utilize free trade agreements and closely manage its vital cash resources.

Free Trade Agreements

Free Trade Agreements (FTA) are programs like the North American Free Trade Agreement (NAFTA) or Mercosur in South America. Goods that “originate” under an FTA are permitted to cross borders at a free or reduced duty rate if they are covered by a valid Certificate of Origin. This is a precise process – inaccurate claims can result in severe penalties and the stoppage of the flow of goods.

For raw materials and purchased finished goods, suppliers are best positioned to provide the trade data for their products. Contracts should always include a requirement to provide this data for all goods. The inability to provide complete data within the specified timeframe manner can have a negative impact sales.

Utilizing FTA is a completely optional program, however a business will want their suppliers to participate for the productivity opportunities. Likewise, a business’s customers will want them to participate for the same reasons.

Broker Management

For many companies, Customs Brokers are not managed, rather they become an extension of the logistics process. Carriers decide HS classifications based on the shipping documentation, and there is no control of customs entries or structured program for minimizing duties.

By defining and standardizing processes, a business can bid out its process and work to the regional strengths of brokers around the globe. Choosing the right partner assists with:

- Establishing standard work or Standard Operating Procedures (SOP)

- Initiating the use of performance metrics and broker scorecards

- Enabling service level agreements (SLA)

- Creating an ability for customs declarations to be audited and verified

- Controlling the cost of trade services

The benefits of an aggressive Broker Management program are a reduction of compliance risk as well as an alignment with Trade policies, a decrease in the cycle time of crossing borders, improved financial controls with minimized Duties paid and the ability to respond to increased regulatory requirements.

Regulatory Partnerships

Programs like the C-TPAT (Customs Trade Partnership Against Terrorism) with US Customs is an example of a voluntary programs implemented for Trade participants. The purpose is to adopt procedures and best practices to secure global supply chains. These program include:

- Faster clearance times and reduced inspections across borders

- Establishment of minimum security requirements

- Use of security best practices along with validation assessments

- Visible component of good corporate citizenship with U.S. Customs

Tools – Automating the Process

The administration of Trade requires tools for the ever-changing world of global regulations. Typically, import/export processes which are manual are susceptible to human error that raises the risk of noncompliance. Additionally, it is difficult ensure that manual processes are in compliance with internal controls. This makes them prone to costly errors and doesn’t allow the business to leverage duty reduction opportunities through free trade agreements. As governments around the world implement new automated tools to detect violations, those businesses without proper systems in place will find their exposure grows exponentially. Benefits of automating Trade are:

- A strengthening of compliance while redirecting focus to training and prevention

- The reduction of the risk of disclosures/penalties to Customs agencies

- Allows the ability to extend global compliance within the current headcount constraints

- Increases duty savings through expanded use of global Free Trade Agreements (FTA)

- Reduces brokerage fees through electronic feeds of import and export data

- Increases the accuracy and responsiveness to customer requests

Case Study

Brazilian Trade Management

Project Description:

In 2011, our business leaders in Brazil complained — quite loudly — that they were having difficulties selling product in the region. The high cost of doing business was a direct result of failures in the supply chain. Our initial observations noted that long lead times, missing shipments and our 3PL’s total indifference to correcting problems were all contributing to the problem. We further determined that our factories in China, Germany, Mexico and the U.S. were completely unqualified and unaware of the intricacies of shipping product to Brazil. This led to cost that were excessive, abundant fines and penalties, and no one in or out of the country doing anything to correct the problem.

A project was undertaken to correct the flows, as well as the high cost of moving product. The goals were to:

- Comply with Brazilian trade regulations by establishing proper business controls

- Eliminate all fines and penalties

- Improve service levels to customers by 25%

- Create a productivity machine by hiring world class experts

- Build a scalable model to enable growth throughout Latin America

Facts to note:

- $4.0M of inventory was continually in transit to Brazil

- Cost pressures were making the Brazilian businesses non-competitive

- A lack of standardized work contributed to the majority of delays and fines

- Delays were routine due to weak execution and paperwork discrepancies.

- Discrepancies were not measured

- The logistics and trade teams were very weak and in need of a significant upgrade

- Regional trade agreements could not be utilized due to the lack of accuracy and complexity of the process

Trade Flows to Brazil

Initial improvements were to:

- Hire a strategic leader who overhauled all Trade and Logistics teams and processes

- Terminated and replaced the indifferent 3PL

- Created a consolidation point in Miami as the focal point for shipping to Brazil

- Immediately ended all non-compliant practices and activities by instituting a policy of:

- If it’s not perfect, it doesn’t go

- Corrected the general ledger to accurately state the cost of doing business

- Globally trained all plant shipping personnel on the requirements to ship to Brazil

- Commenced tracking cycle times and setting targets for every shipment

- Developed a formal relationship with Brazilian Customs to demonstrate resolve towards correcting the historical poor business performance

- Implemented standard metrics to provide visibility and established a monthly review with the business leadership to resolve open issues and track improvements

- Transitioned to a new bonded warehouse, which improved local cycle time by 1-2 days

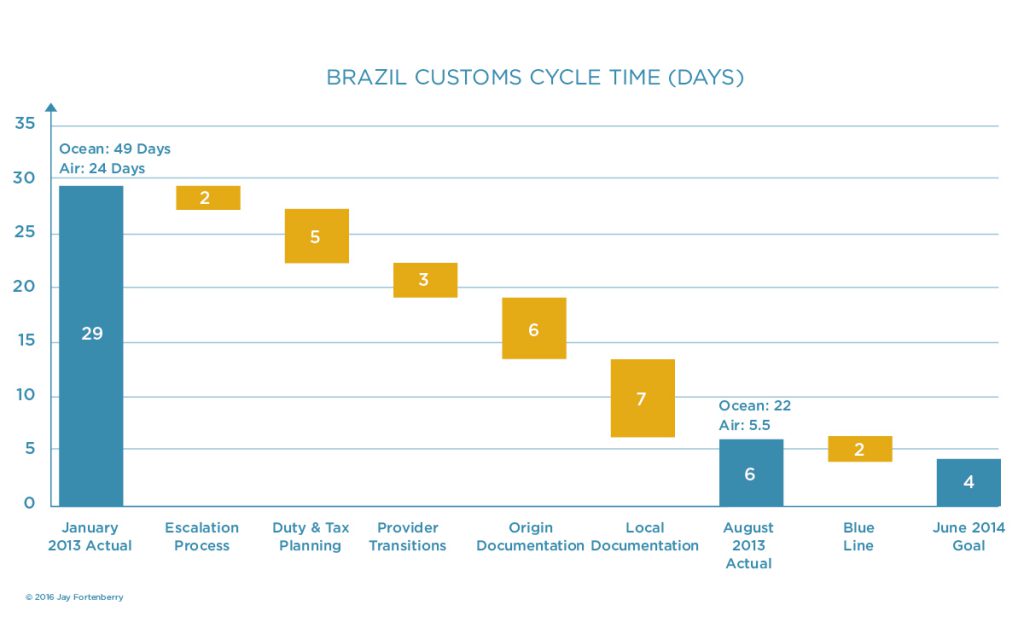

Results:

- Reduced Brazil customs clearance time from 29 to 6 days. This produced a $3M improvement in working capital performance

- Obtained a classification rulings from Brazilian Customs to avoid misinterpretations and conflicting assessments from Customs inspectors

- Created $850K of productivity from duty reductions

Brazilian Cycle Time Reduction

Conclusion:

Having previous experience with shipping to Brazil, I’d always sensed that something was awry in the company’s activities in that region, but when I’d asked where the fines and penalties were, I was consistently told that there weren’t any. I knew better than that, but no one was complaining and we had other hotspots around the globe to worry about.

In 2012 we placed a full time country leader for the business in Sao Paulo from the U.S. Once he was settled we began to work together to identify and work through the issues one-by-one. This was a great project that should have been done years earlier. Some of what we learned included:

- Brazil is a complicated place to do business, and this is especially true if you’re only distributing product rather than manufacturing. Building an elite Brazilian trade and logistics team was the initial key to stopping the bleeding.We were able to standardize and correct longstanding issues with Brazilian Customs. This yielded significant productivity and reduced cycle time, which lowered working capital requirements for the business while building a scalable model for growth in the region.

- Terminating the indifferent 3PL provided immediate benefits in quality, costs and delivery.I had flown my Americas team into Miami multiple times to work with the 3PL on correcting issues. We spent months trying to fix things, only to find that our Logistics provider was subverting us by continuing to incorrectly ship goods to Brazil. I got on a plane and flew down there to meet with their CEO. After encountering their total indifference, I dragged him onto the warehouse floor and asked if these exceptions were acceptable. The response was a whining conversation about rate levels and other operations around the globe. At that point I really lost it and set out to terminate them as quickly as possible.

- Partnering with the local Business Leaders eliminated the rock throwing. Stopping the conversations with the chairman allowed us to fixing problems much more quickly. Once we were able to demonstrate our resolve to repair things we were able to build credibility and get the breathing room we needed to start the improvement process. The monthly review process allowed everyone to both air their grievances and to acknowledge improvements and celebrate success. It took about 8 months to stop the hemorrhaging and begin to turn things around, and about 18 months to become world-class.

Final Thoughts on Trade for Today

In my experience, involving members of the Trade Team at the outset has consistently resulted in the reduction of cycle time by flowing goods correctly from the beginning. The direct benefit is a reduction of the working capital required to service the region, as well as creating a productivity machine from Duty Savings and preferably, Avoidance.

Guys like Bill, Karl, David, Bryce, Dario and Nilton, etc. were among the best supply chain managers I’ve met in manufacturing or sourcing, and we were damn good together. These folks know the law and what is possible, and they work very hard to open doors for the business while producing savings around the world. real asset. A good Trade person is a real asset (as opposed to a liability) and will return their cost tenfold.